In 2019, the payment volume on the platform reached an astonishing $712 billion. This number is expected to rise, considering that more businesses, entrepreneurs, and freelancers are turning to online payments. It’s safe to say that anyone who engages in online transactions regularly has a PayPal account. But despite its enormous user base, it’s far from monopolizing the world of online payments. Plenty of PayPal alternatives exist, with some trying to match all of its features while others prefer focusing on a few that make them stand out amid the fierce competition. Whether you’re a freelancer, small business owner, or an e-commerce entrepreneur, it’s worth looking into the best PayPal alternatives to improve the user experience of your customers and even increase your profits by avoiding the steep PayPal fees.

Apps Like PayPal

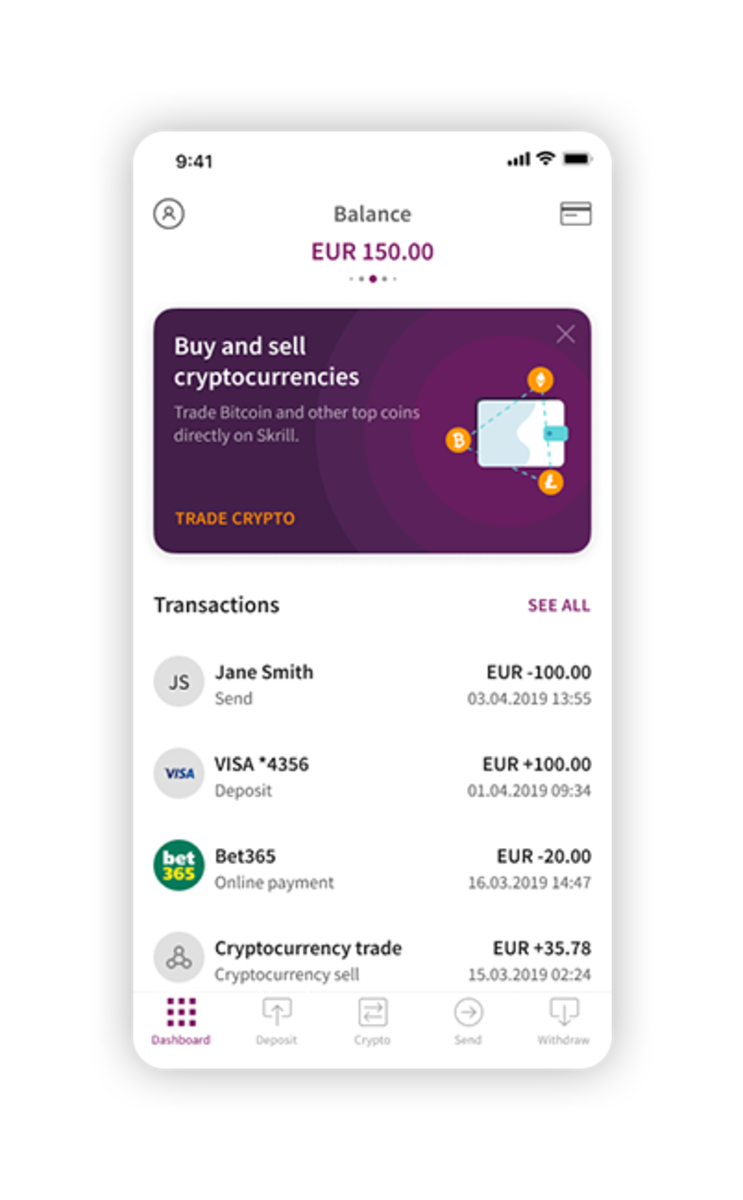

1. Skrill

For many people, Skrill comes closest to PayPal in terms of features. But what draws people toward Skrill is the fact the fees are much lower compared to those in its biggest rival. Skrill only charges 2.9% for a merchant transaction fee, while PayPal charges 4.5%. That may not seem like a lot, but it adds up over time. Private users also love that Skrill offers zero fees on deposits, withdrawals, and sending and receiving money. If you’re fed up with PayPal charging you with all sorts of fees for every transaction you make, then you’ll surely appreciate Skrill.

Downsides

Skrill can’t compete against PayPal in terms of merchant acceptance. Many retailers still haven’t added Skrill to their list of payment options. You may also be charged with an inactivity fee of $5 if you don’t use your account for 12 months.

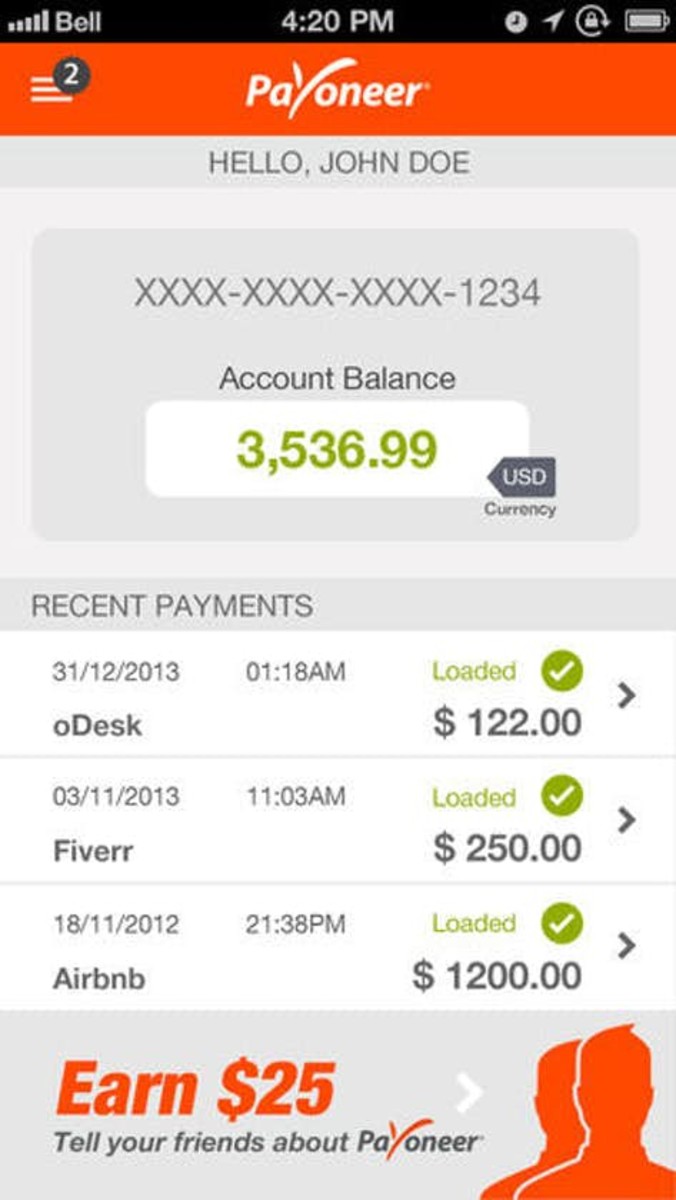

2. Payoneer

Payoneer is one of the first names that comes to mind when talking about PayPal alternatives. It’s immensely popular across the globe, operating in more than 200 countries. It might also come as a surprise that Payoneer has been around almost as long as PayPal. When using Payoneer, you can choose between two types of accounts: If you’re running a business, then you may also want to check out their Billing Service. It lets you set up a system for requesting payments from customers. Credit card transactions are charged 3% while debit card transactions are charged only 1%.

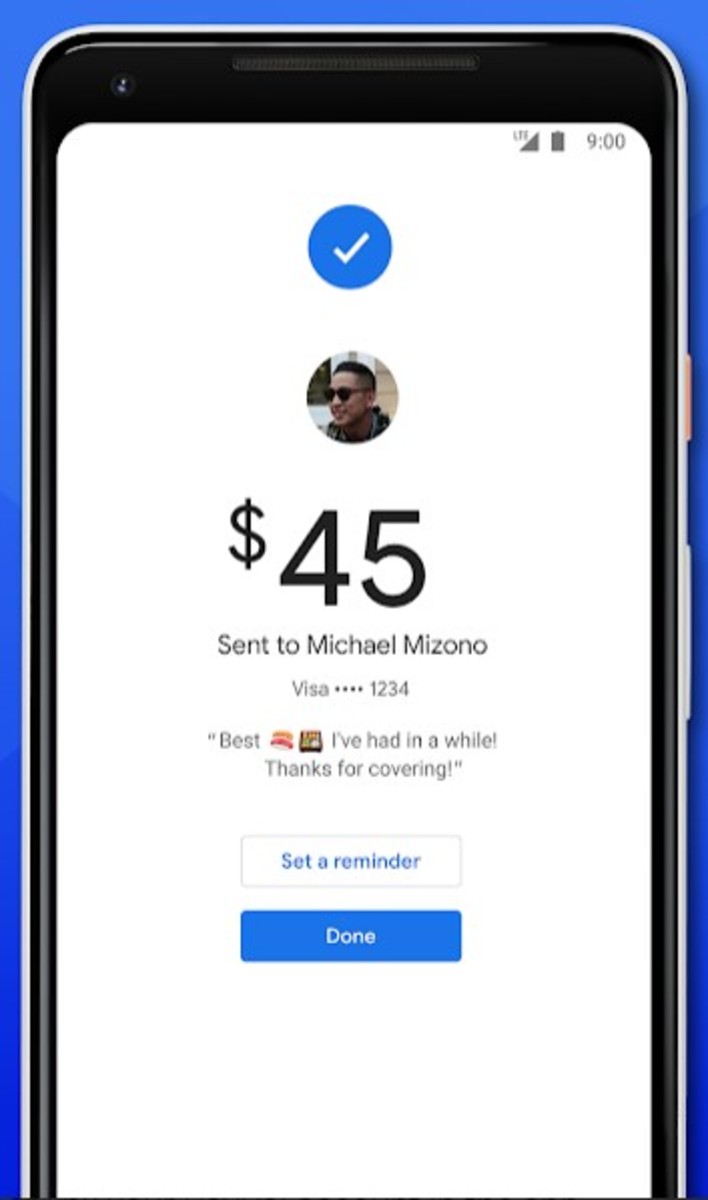

3. Google Pay

Google Pay is relatively new in the digital money industry, but it sure knows how to make a massive impact almost immediately upon release. Since it’s owned by Google, it’s easy for them to integrate their own payment solutions into several of their popular services. For instance, you can set up a Google Pay account and attach payments to Gmail messages. Just think about how convenient that is both for you and your customers. What’s more, Google Pay offers zero fees on debit transactions. You can even add Google Pay on your website, giving customers an additional option for paying for your products or services. Several merchant functions are in store for you as well, including tools for managing your business and implementing loyalty programs to entice more sales.

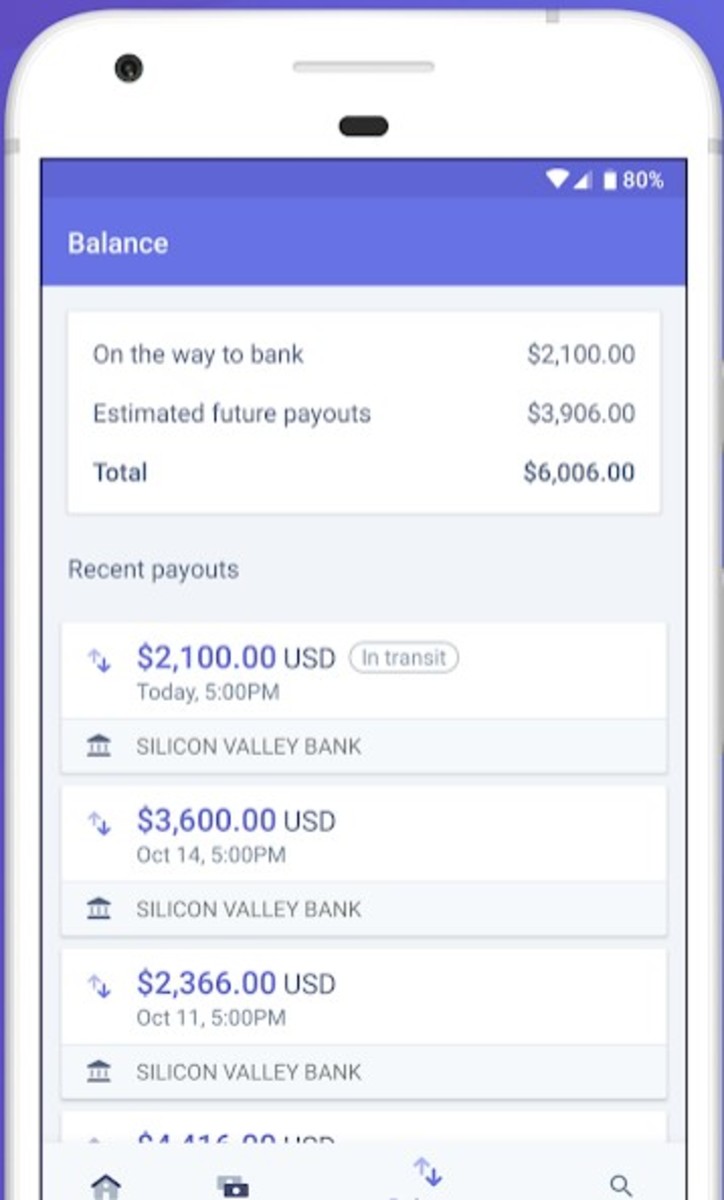

4. Stripe

If you’re the type who loves sifting through online stores, then Stripe should sound familiar. In fact, plenty of e-commerce platforms use Stripe as their primary payment processor. It has grown incredibly over the past few years, thanks to the boom in online shopping trends. Stripe proves to be an excellent PayPal alternative, but you should understand that it’s geared toward online store owners. A lot of people don’t know that Stripe is the brand responsible for the success of Shopify Payments. The company set out to make online transactions as easy as possible for all parties involved. Everything happens on Stripe, from accepting payments regardless of their source to sending payments directly to the bank account of users. They even process Bitcoin payments. The transaction fees are comparable to those in PayPal, but Stripe should be worth a look if you operate an e-commerce business.

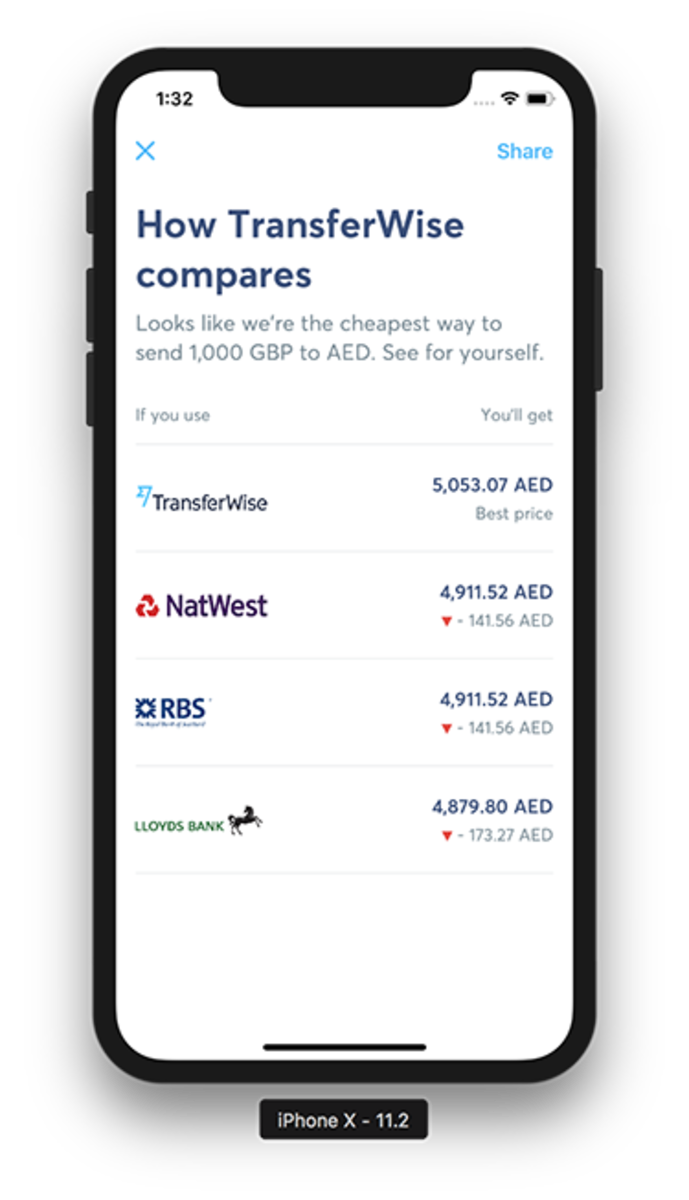

5. TransferWise

When it comes to international transfers, TransferWise gives PayPal a run for its money. They even offer a comparison tool that lets you see clearly just how much money you can save by using their platform. With their multi-currency borderless account, users can receive, send, and spend money without worrying about absurdly high fees.

How Does TransferWise Keep Fees to a Minimum?

It’s rather simple: If you’re in the US and you want to transfer money to a friend in Italy, your payment will be sent to TransferWise’s own bank account in the US. They will use their bank account in Italy to send the money to your friend. As you can imagine, this enables them to execute blazing-fast transfers while avoiding unnecessary fees.

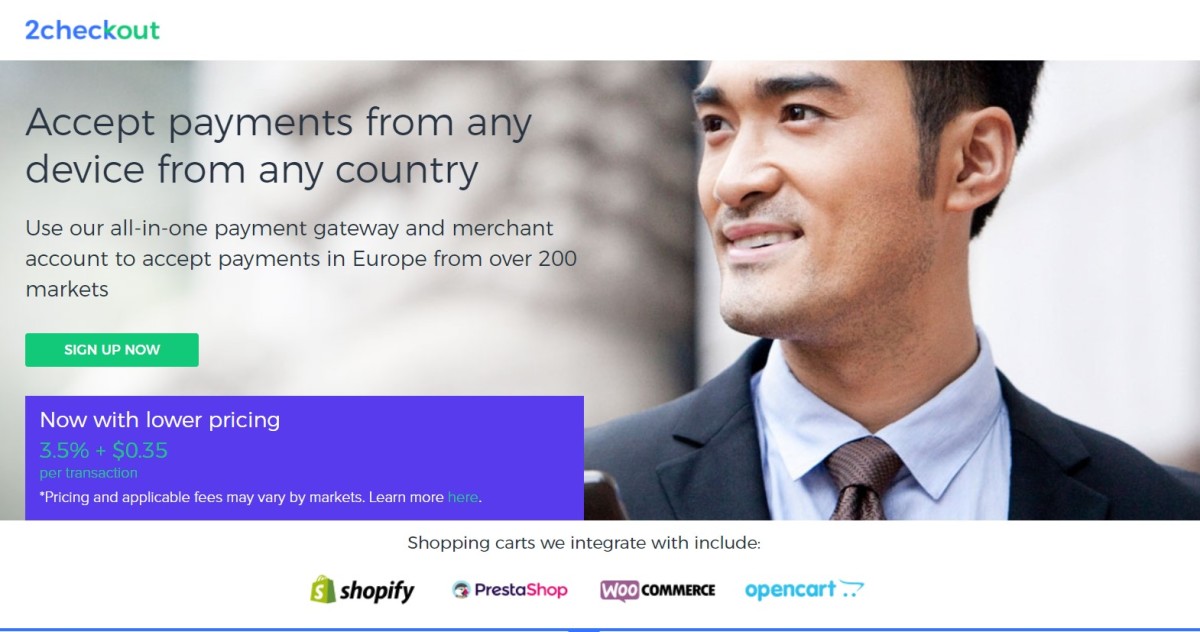

6. 2Checkout

A lot of PayPal users have switched to 2Checkout—and for good reason. This platform is known as a global checkout platform, allowing you to accept payments from all over the world. Currently, 2checkout supports a total of 87 currencies. One of the reasons why 2Checkout is a great PayPal alternative is that while it charges you the same transaction fees when you’re in the US, for other countries, the fees are considerably lower. This makes it well worth checking out if you’re outside the US and don’t want to deal with the high fees in PayPal anymore. As for payment methods, the platform accepts debit cards, credit cards, and PayPal.

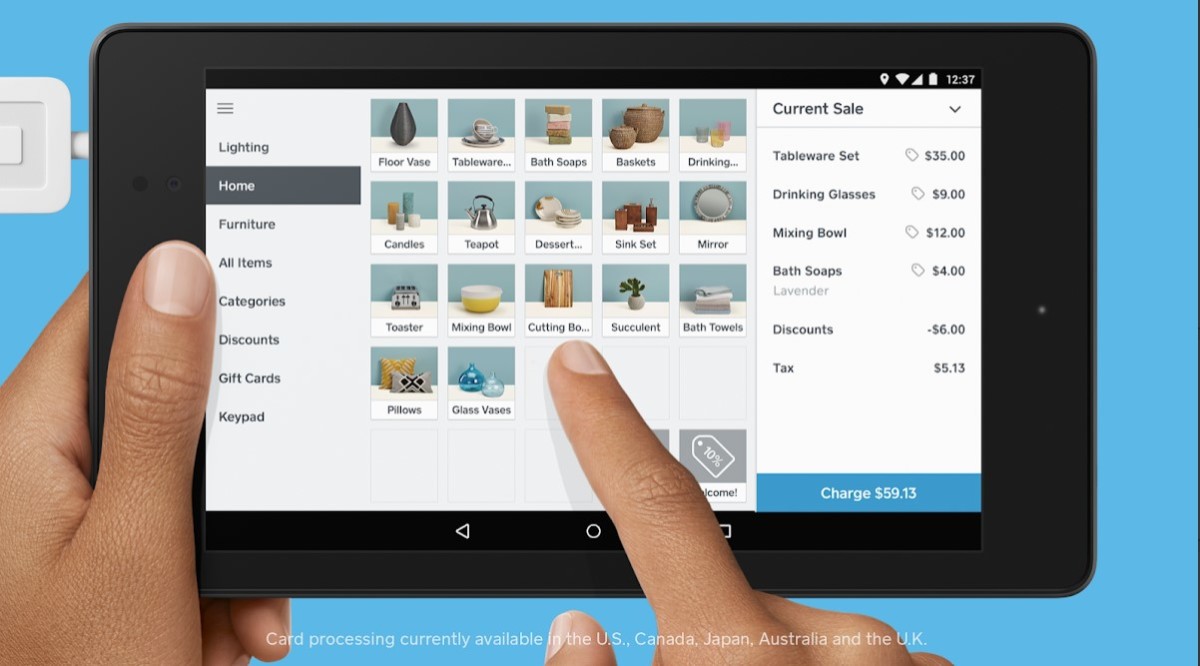

7. Square

Square probably offers the most complete package out of all the online payment processors on this list. It’s extremely popular among online business owners because it allows you to set up an online store and even get a free domain name. Setting up your e-commerce business is easy with Square because of the shopping cart integration, card info storage vault, invoicing tool, and virtual terminal features. You can also accept credit or debit card transactions using their POS and mPOS integrations. If you want all the bells and whistles, you can purchase their add-ons, including payroll solution, appointment booking, and employee management. Without question, Square should rank high on your list if you want to manage all payment-related transactions for your business.

Downside

Unfortunately, only merchants based in the US, Canada, UK, Australia, and Japan can accept credit card payments. This is quite a huge disadvantage, especially for business owners outside of said countries.

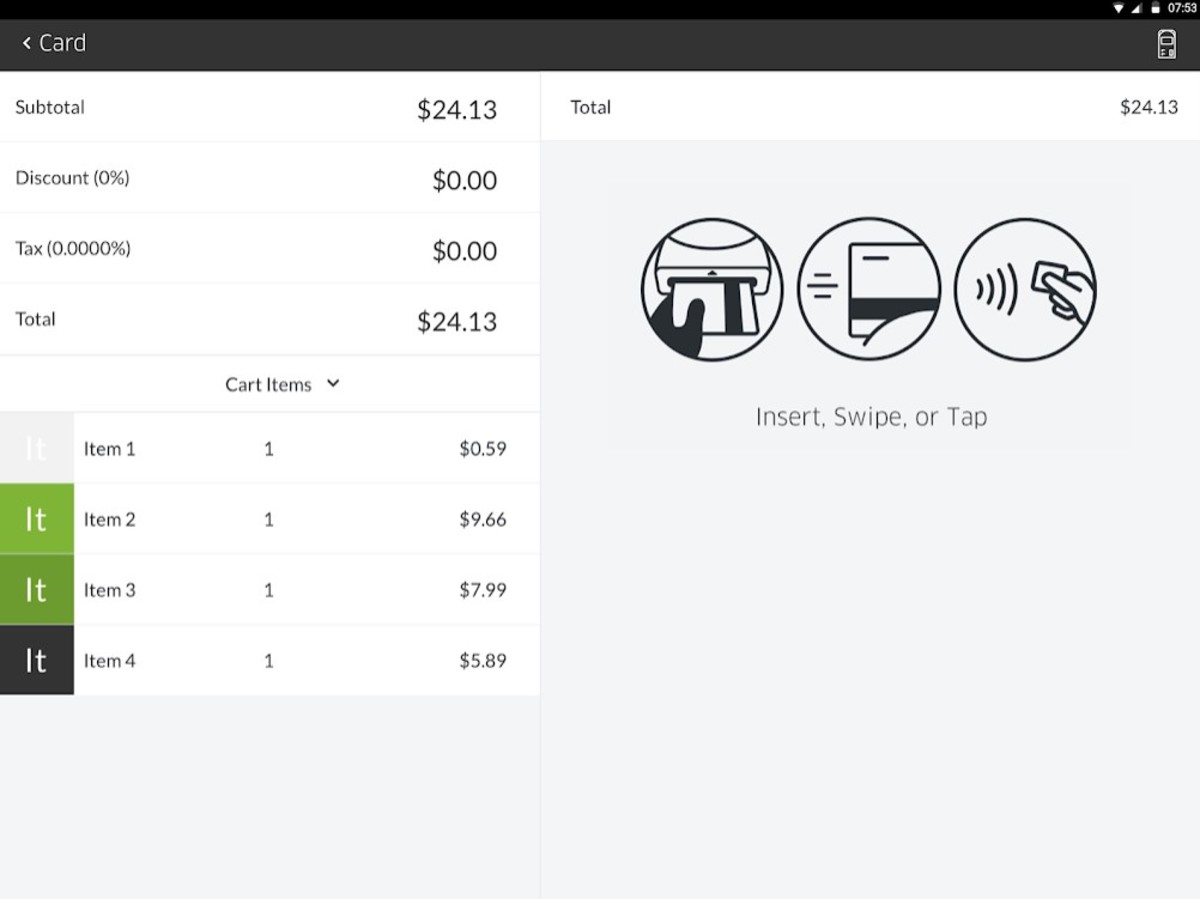

8. Payline

Payline may not ring a bell, but you may want to look into it, especially if you’re in the retail business. It’s an app like PayPal that proves to be more than just a payment processor. It offers a myriad of solutions geared at making mobile and online payments fast, easy, and secure. With Payline, you can set up an e-commerce checkout system in the same way you could integrate the other payment solutions on this list. But where it shines is in the way it offers a flexible payment system for retail businesses. It can get confusing, though, because Payline uses an interchange-plus pricing system. This means that the fees can go up and down, depending on the type of card you’re processing. While the static pricing schedule is more straightforward, you’ll come to appreciate the interchange model by Payline once you see how transparent it is. Payline should be a strong contender for anybody who wants to streamline in-store payments.

9. Venmo

If you’re looking for an alternative to PayPal that you’ll only use for sending money to friends or family, then Venmo is a fantastic choice. It’s a subsidiary of PayPal, so you can find comfort in the fact that a massive brand is backing it up. Venmo is particularly popular among the younger generation because of the social elements integrated into its platform. Venmo provides you with a digital wallet that you can link to your bank account. There’s a feed, much like the one you see in your social profiles, in which you can leave comments about the transactions you make. The best thing about this app is that you can send money from your bank account for free. Paying via credit card, however, comes with a 3% fee. Take note that Venmo is best used for sending money to people you personally know. If you’re a freelancer or a business owner who needs to accept payments from customers, you’re better off with the other apps on this list.

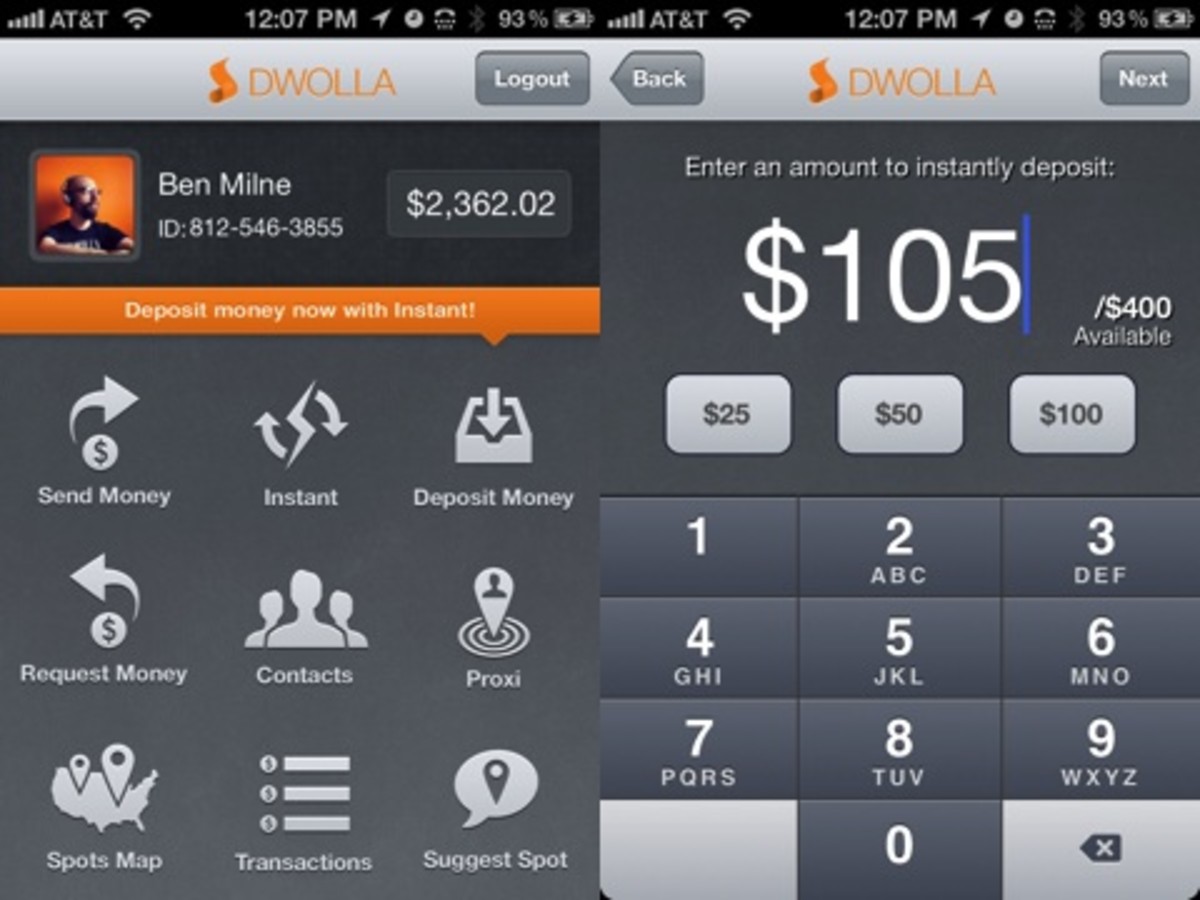

10. Dwolla

Dwolla works similarly to Venmo. It’s an app that lets you send money to your contacts. Everything is almost the same, but Dwolla charges a small fee of $0.25 for transfers greater than $10. One reason you might want to use Dwolla instead of Venmo is its strict verification process. After signing up, you may have to provide an ID and go through a photo verification. The approval usually takes 2 business days. You can only use Dwolla in the US. On the plus side, you can rest assured knowing that you’ll only have to pay a small fee regardless of the amount of money you transfer.

Choose the PayPal Alternative That Fits Your Needs

PayPal is still the go-to online payment processor by the majority of business owners, freelancers, and private users. But just because it’s the most used online payment solution doesn’t mean you need to ignore the other apps and websites that can prove to be just as good or even better. It all boils down to identifying your unique needs and finding the right payment platform that offers all of the features you’re looking for. And of course, don’t forget to compare the transaction fees to determine which one allows you to save the most money in the long run.

Comments

Dale Anderson from The High Seas on September 13, 2020: I’m really enjoying your articles here so please keep them coming!